|

When is the last time you sat back and contemplated this wonderful world and life in which we live?

When was the last time you listed all the things you were grateful for? Or the blessings you have and/or been given? As I watched the sun come up over Mauna Kea as I stood inline to start my Ironman race on the Big Island of Hawaii this last weekend, I could not help but think of the beauty all around me and in our lives. Here are 10 beautiful things about life...

0 Comments

It's time to become Un-Common. Most people live their lives in a comfort zone and don't ever realize their potential. This is common and they are common, but this is a call for all reading to throw off the status quo and become the Un-Common among the common. It is a call for you to stand out and to be better. It is a call for you to push yourself and answer those questions deep down that have been nagging at you about who you are and who you should be.

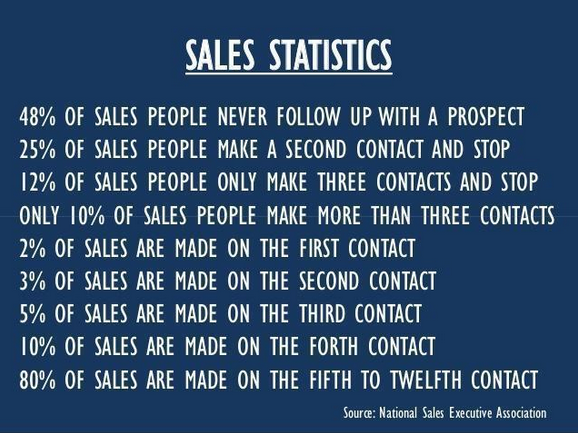

The Un-Common person is someone who creates high standards and lives into them. They are someone who is never finished and never "makes it." No matter what level of success they reach in every area of their life, they know there is another level possible and it is this possibility that drives them, energizes them, and gives them un-relenting, un-matched passion for life. But, they are also confidently humble. They know they are Un-Common, but they also know that to be Un-Common is something that everyone else is capable of being in their own way and are excited to help others tap into this potential. To be Un-Common is to go above and beyond and stretch your limits. It is not only striving and becoming the best, but also redefining what it means to be "the best." It is an ethos, a mentality, and a lifestyle. And it is asking the questions, "What am I willing to do? What limit can I breakthrough next? Are there really any limits?" Lastly, and most importantly, the Un-Common know that the biggest battle they will fight are the limits in their own mind. And they go to war every day to defeat the enemy of self-doubt, complacency, and self-imposed limitation. They are committed for life, hungry, and never give in. So, how about it? Are you ready to become Un-Common? The Un-Common don't start out being the best, they work their way there over time. Pick one thing today that will break you out of comfort or push you beyond you limits. Do it. And then once you've done it and proved to yourself it is possible, start asking what is possible? Are there really any limits? Then go. It's time to become Un-Common. Read the above stats very carefully. Maybe read it a couple of times to let it sink in.

80% of the sales are made on the 5TH TO 12TH CONTACT. How many times do you or your sales people follow up with prospects to close business? It if is not at least 5 times, then you are missing out on sales. Why do l2% of salespeople follow up 3 times or less? I think it is because most salespeople don't want to be seen as "bugging" anyone or being "pushy." We can all understand this and don't like it when salespeople are over-aggressive with us. The key to managing this is to find a balance between what I call being Professionally Persistent and over-aggressive. Usually, the reason salespeople become over-aggressive is because they become desperate to make a sale or hit their numbers and go after what they think is the most likely sale. This desperation shows and as such, they are not professional and come off as abrasive, annoying, and in some instances mean to the client. Conversely, being Professionally Persistent is the opposite. It comes from confidence, patience, and an understanding that the process has to play out. It is being consistent, courteously following up, and maintaining visibility with the prospect until they are ready to make a decision. Being Professionally Persistent requires maturity and the ability to manage emotional responses. It also takes the ability to remain calm and professional under pressure and the fortitude to stick with things over time. It also requires and attention to detail. Developing the habit of becoming Professionally Persistent takes work and time, but it literally pays to do so. Make it a priority today! Academic qualifications are important and so is financial education. They're both in important and schools are forgetting one of them. - Robert Kiyosaki We do not teach financial education in traditional schooling, other than maybe an elective class that is very basic. I believe this is one of the worst injustices of our school system. Personal and business finance are critical to succeeding the real world and we hardly talk about it. Part of me wonders if it is done on purpose, because it is so glaringly obvious that it is needed and yet, it is give little attention. Or maybe, it is because our school model is made to churn out employees who live off a W2 and those in power don't think they need to know finance.

Setting aside the cynicism, regardless of school, you should make it a priority to self-educate on personal and business finance. To help you get started, here are 3 money habits you should adopt starting today. Understand Your Cash Flow "Cash flow" is just a term to define where you money goes. First, you start with how much you make. If you are an employee, you cannot just take your salary. You have to look at your "take home pay" after taxes are taken out. Once you know that number, that is the amount you have to spend on supporting your life and needs/wants. From there, take inventory of your expenses and list them out. If they are less than your "take home," congrats you have a surplus. If your expenses are more than your take home, then you have a deficit. Obviously you want a surplus and it seems like common sense, but most people rarely if ever go through a basic cashflow and budgeting exercise, even as simple as this. As a habit, you should review your cash flow monthly and have a written budget of your take home income and expenses and watch it over time to make sure you keep a surplus. And you should do everything you can to increase your take home and lower expenses where it makes sense. Once you have a surplus going, that brings us to the second habit you put into practice. Six (6) Months Expenses Saved The second habit I personally do and advocate is the save 6 months expenses and keep it in an interest bearing account that at least keeps up with inflation. Why 6 months? It's pretty simple. If something bad happens, you will have enough to carry you through for a good while and not have to stress. Most advocate 3 months, but in really bad times, it can take longer to get back on your feet if you lose a job or like many during Covid, their business. A 6-month cushion would get most through the rough times. The hard part is finding an interest bearing account that can either keep up with or beat inflation. Right now, it is almost impossible to find an account or even a CD that pays enough to beat inflation. But, if you don't have 6 months saved, focus on that and then once you are there, you can search things TIPS, 1 Year CD rates, High Interest Checking, or even look at things GetLinus which pays 4% or more. One important note is that if you have high interest debt like credit cards, etc., focus on paying that off first and then save for your 6 months. The only debt you should have is things like mortgage and car loans at the lowest possible rates you can get. Start Your Financial Self-Education NOW While you are doing the above to get yourself on solid ground, start your third habit, educating yourself in finance. As you learn and grow and get more of a surplus, you can then invest it and begin to really see the benefits. For example, the day I wrote this, I sold an Iron Condor trade on the Nasdaq 100 index which made me $500. I entered the trade around 11am and exited around 3pm. Not bad for a few hours while I was doing other work. If that sounds like Greek to you, I understand. When I first started out, I had no idea what any of this stuff was, how it worked, or how to do it. But, years later after continuous financial self-education I do and use it to my advantage. I have learned to create income in the stock market, real estate, through private placements and small business funding, and of course by building and growing my businesses. In fact, the tax laws are written to benefit business owners and investors, not a W2 employee. They are written this way because those areas are where jobs are created and a W2 is the highest form of income the government can get. Back to my cynicism - maybe that is the reason we don't teach financial education in government run schools, because those that get educated, pay a lot less in taxes and are don't become W2 employees. But, that is not you - at least I certainly hope not, and after reading this, I hope you are inspired to self-educate and learn the amazing benefits that await you from financial education. Get started NOW! Les Brown is one of my favorite speakers. He delivery of great wisdom is un-matched. I urge you to listen to this message from Les on success and why you've "gotta be hungry" in your life and how you can truly level up. Enjoy!

|

Click Below to Join Misfit Nation and Get Your Free Copy of "The Top 10 Lessons to Thrive and Succeed!"

Archives

July 2024

Categories

All

Follow Misfit on Twitter!

|

© MISFIT ENTREPRENEUR 2018. ALL RIGHTS RESERVED. Terms and Conditions. Privacy Policy. Affiliate Disclaimer

RSS Feed

RSS Feed